Steel Price Forecast and Steel Market Outlook

Aug 29, 2023

Prices soften on weaker steel demand outlook

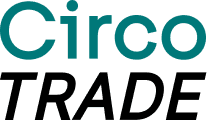

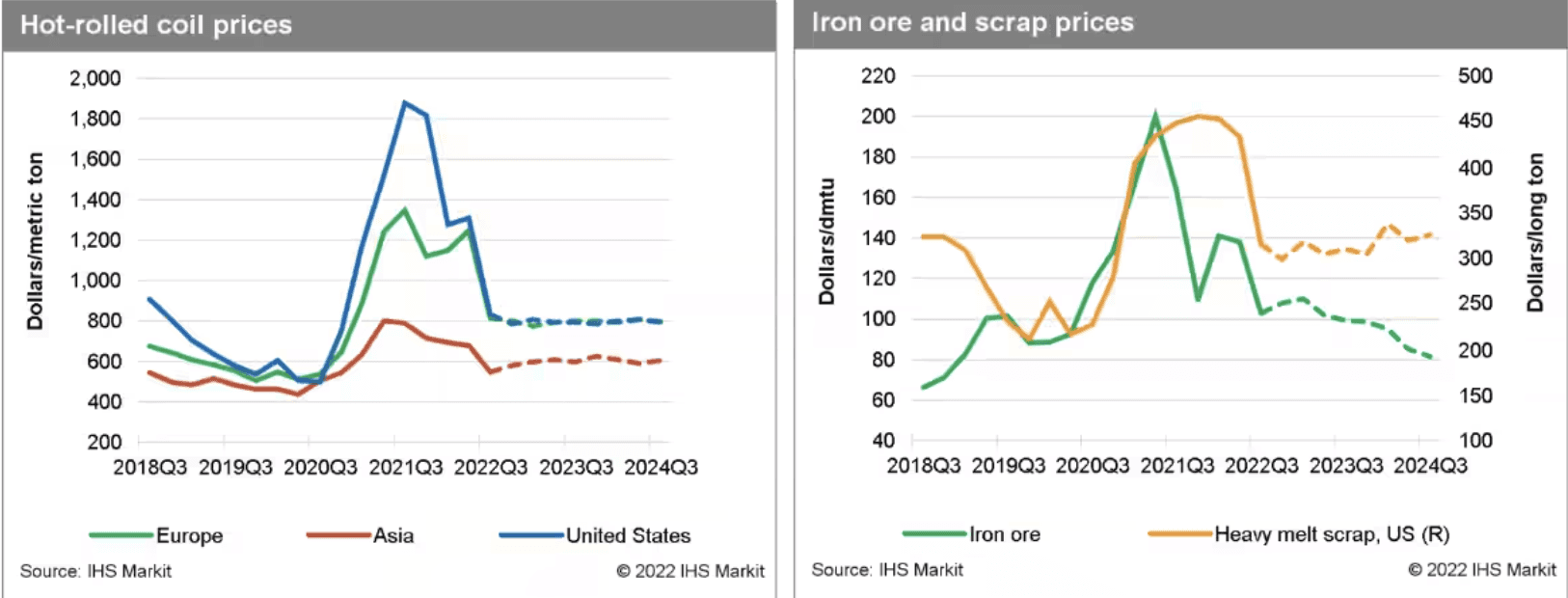

Steel prices essentially collapsed in May through early July. The Russian invasion of Ukraine caused prices to rise by $500 per ton in Europe and the United States, but they were already back down by $600 or more by mid-July. Another $200–250 per ton is expected for coil; the question is whether the rapid collapse continues, meaning steel prices fall fast and reach a bottom by the end of 2022, or whether the remaining decline stretches into 2023. We are adopting the second scenario, as prices consolidate when electricity and natural gas shortages restrain steel production. Risk, however, is dominant to the downside. In fact, the only strong upside risk through the end of 2022 is energy shortages become so severe that steel production is cut severely.

Steel supply fears are largely gone. The almost immediate recovery in Russian exports of ore, scrap, and semifinished means that steel production disruption has not been significant in Europe or North America. Almost the only upside risk to steel prices is an embargo of Russian steel and raw materials. However, this appears unlikely as all political effort has targeted petroleum.

Bottom line: Steel prices are plummeting although still above their long-term average. More declines will come so delay locking as long as possible. Beware steel production cuts if electricity is rationed.

Prices soften on weaker steel demand outlook

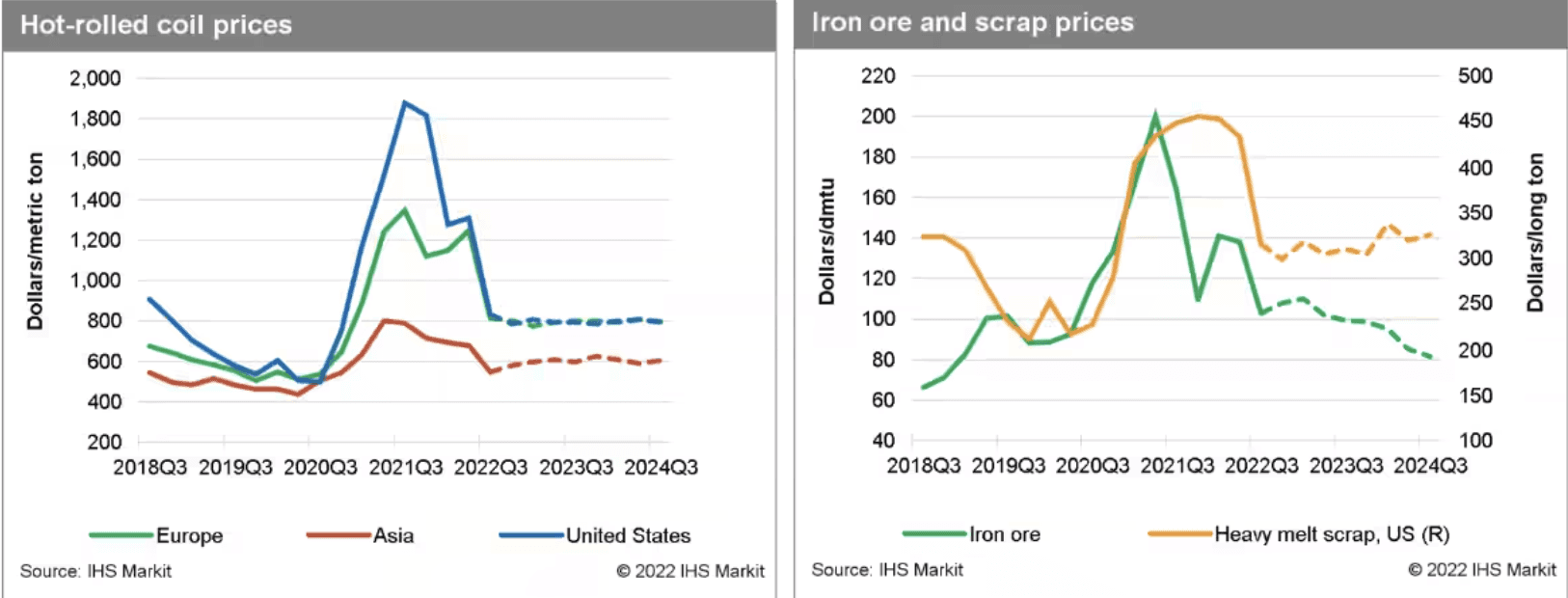

Steel prices essentially collapsed in May through early July. The Russian invasion of Ukraine caused prices to rise by $500 per ton in Europe and the United States, but they were already back down by $600 or more by mid-July. Another $200–250 per ton is expected for coil; the question is whether the rapid collapse continues, meaning steel prices fall fast and reach a bottom by the end of 2022, or whether the remaining decline stretches into 2023. We are adopting the second scenario, as prices consolidate when electricity and natural gas shortages restrain steel production. Risk, however, is dominant to the downside. In fact, the only strong upside risk through the end of 2022 is energy shortages become so severe that steel production is cut severely.

Steel supply fears are largely gone. The almost immediate recovery in Russian exports of ore, scrap, and semifinished means that steel production disruption has not been significant in Europe or North America. Almost the only upside risk to steel prices is an embargo of Russian steel and raw materials. However, this appears unlikely as all political effort has targeted petroleum.

Bottom line: Steel prices are plummeting although still above their long-term average. More declines will come so delay locking as long as possible. Beware steel production cuts if electricity is rationed.

Prices soften on weaker steel demand outlook

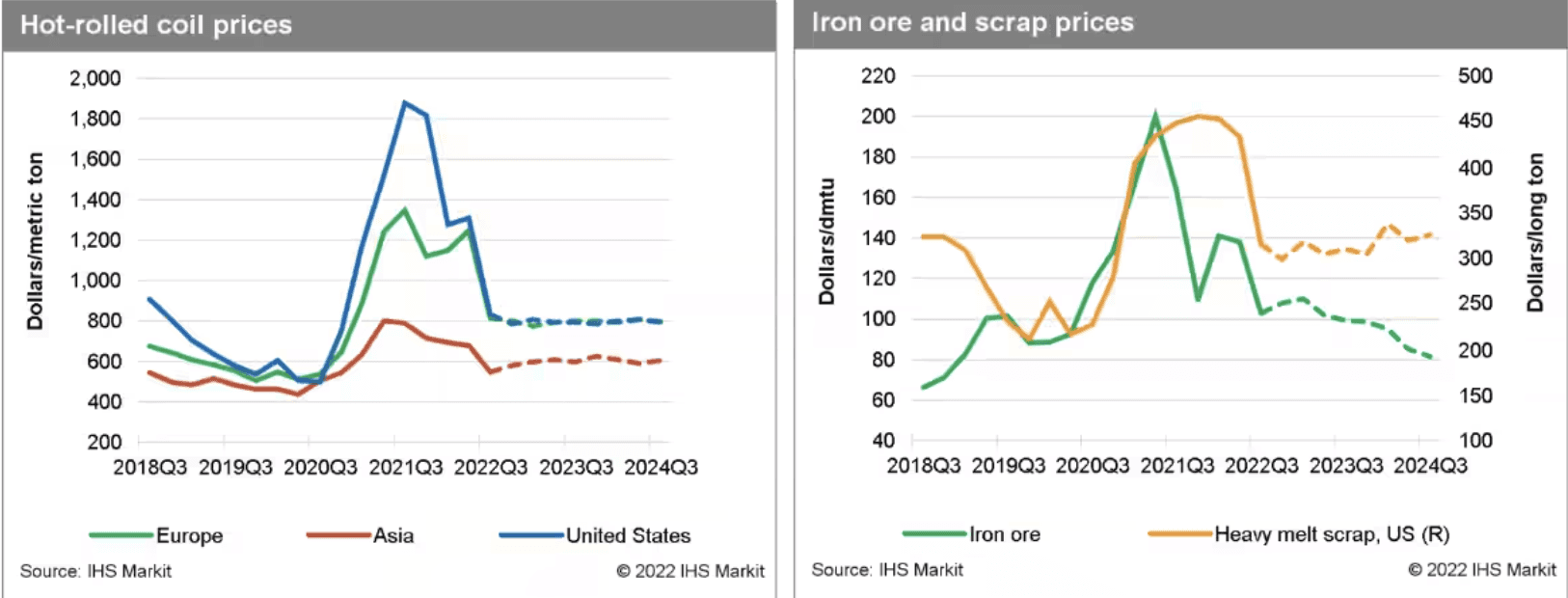

Steel prices essentially collapsed in May through early July. The Russian invasion of Ukraine caused prices to rise by $500 per ton in Europe and the United States, but they were already back down by $600 or more by mid-July. Another $200–250 per ton is expected for coil; the question is whether the rapid collapse continues, meaning steel prices fall fast and reach a bottom by the end of 2022, or whether the remaining decline stretches into 2023. We are adopting the second scenario, as prices consolidate when electricity and natural gas shortages restrain steel production. Risk, however, is dominant to the downside. In fact, the only strong upside risk through the end of 2022 is energy shortages become so severe that steel production is cut severely.

Steel supply fears are largely gone. The almost immediate recovery in Russian exports of ore, scrap, and semifinished means that steel production disruption has not been significant in Europe or North America. Almost the only upside risk to steel prices is an embargo of Russian steel and raw materials. However, this appears unlikely as all political effort has targeted petroleum.

Bottom line: Steel prices are plummeting although still above their long-term average. More declines will come so delay locking as long as possible. Beware steel production cuts if electricity is rationed.

Prices soften on weaker steel demand outlook

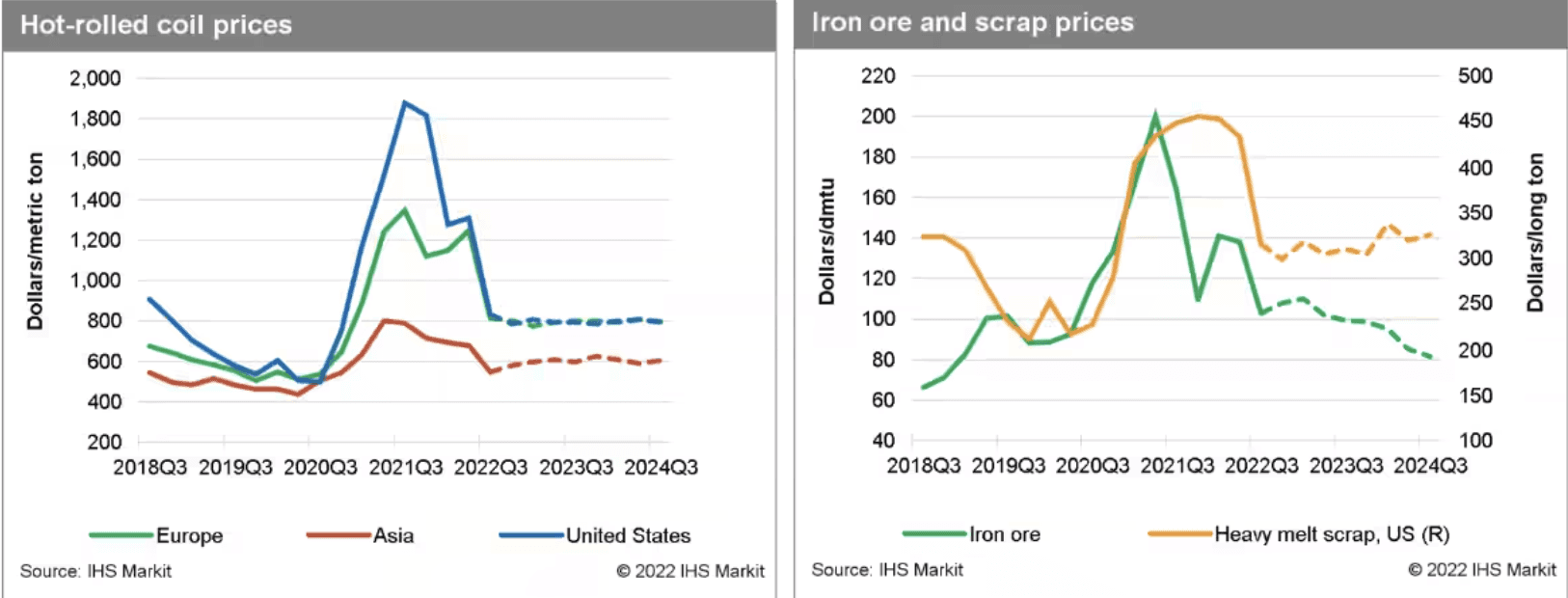

Steel prices essentially collapsed in May through early July. The Russian invasion of Ukraine caused prices to rise by $500 per ton in Europe and the United States, but they were already back down by $600 or more by mid-July. Another $200–250 per ton is expected for coil; the question is whether the rapid collapse continues, meaning steel prices fall fast and reach a bottom by the end of 2022, or whether the remaining decline stretches into 2023. We are adopting the second scenario, as prices consolidate when electricity and natural gas shortages restrain steel production. Risk, however, is dominant to the downside. In fact, the only strong upside risk through the end of 2022 is energy shortages become so severe that steel production is cut severely.

Steel supply fears are largely gone. The almost immediate recovery in Russian exports of ore, scrap, and semifinished means that steel production disruption has not been significant in Europe or North America. Almost the only upside risk to steel prices is an embargo of Russian steel and raw materials. However, this appears unlikely as all political effort has targeted petroleum.

Bottom line: Steel prices are plummeting although still above their long-term average. More declines will come so delay locking as long as possible. Beware steel production cuts if electricity is rationed.

Read Related Articles

Are you interested in working with us? Let’s do somethings great!

Contact Circotrade

2024 All Right Reserved by Circotrade

Contact Circotrade

2024 All Right Reserved by Circotrade

Contact Circotrade

2024 All Right Reserved by Circotrade

Contact Circotrade

2024 All Right Reserved by Circotrade