Savills upgrades five-year forecast for UK house price growth

Aug 15, 2023

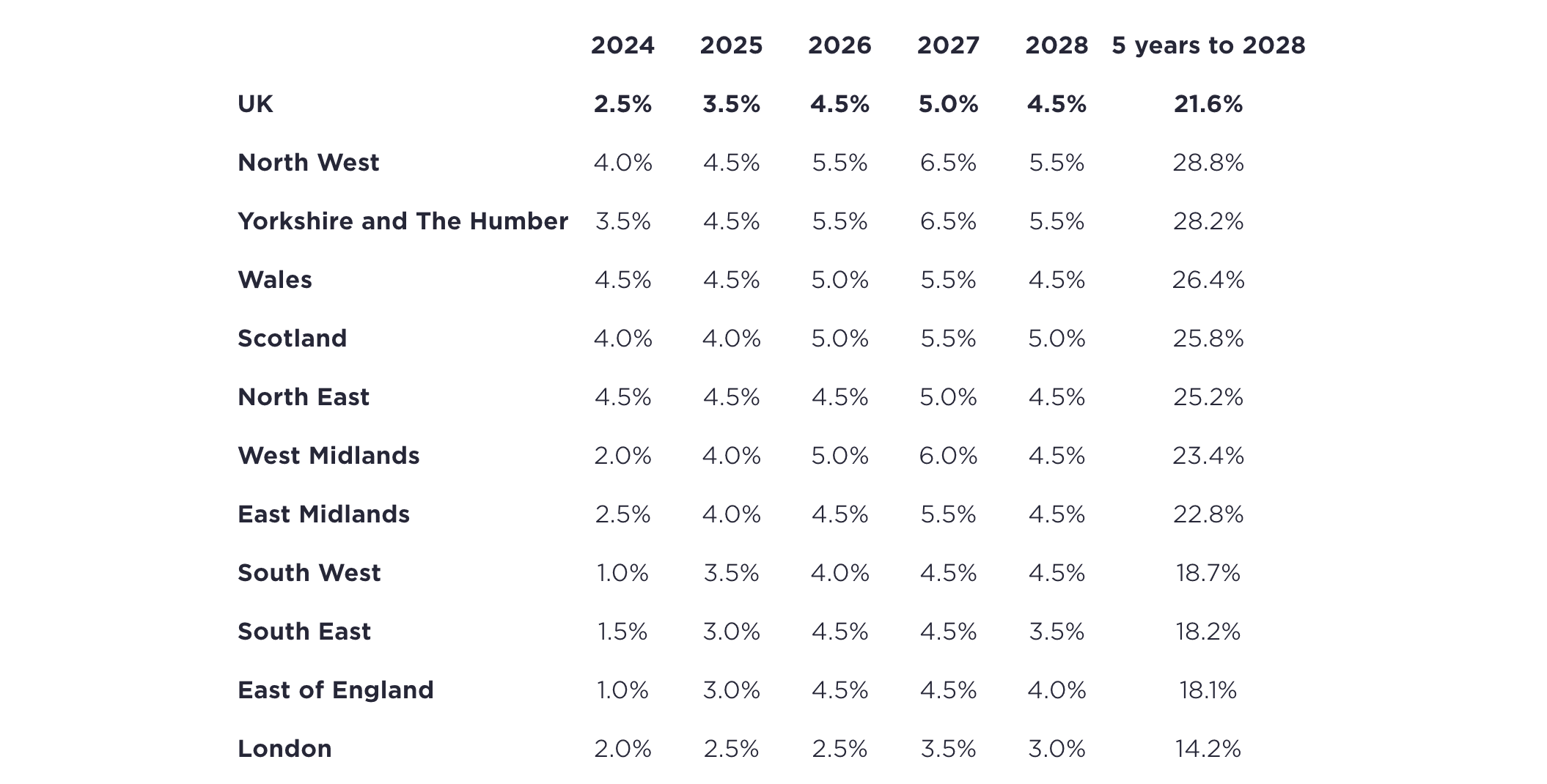

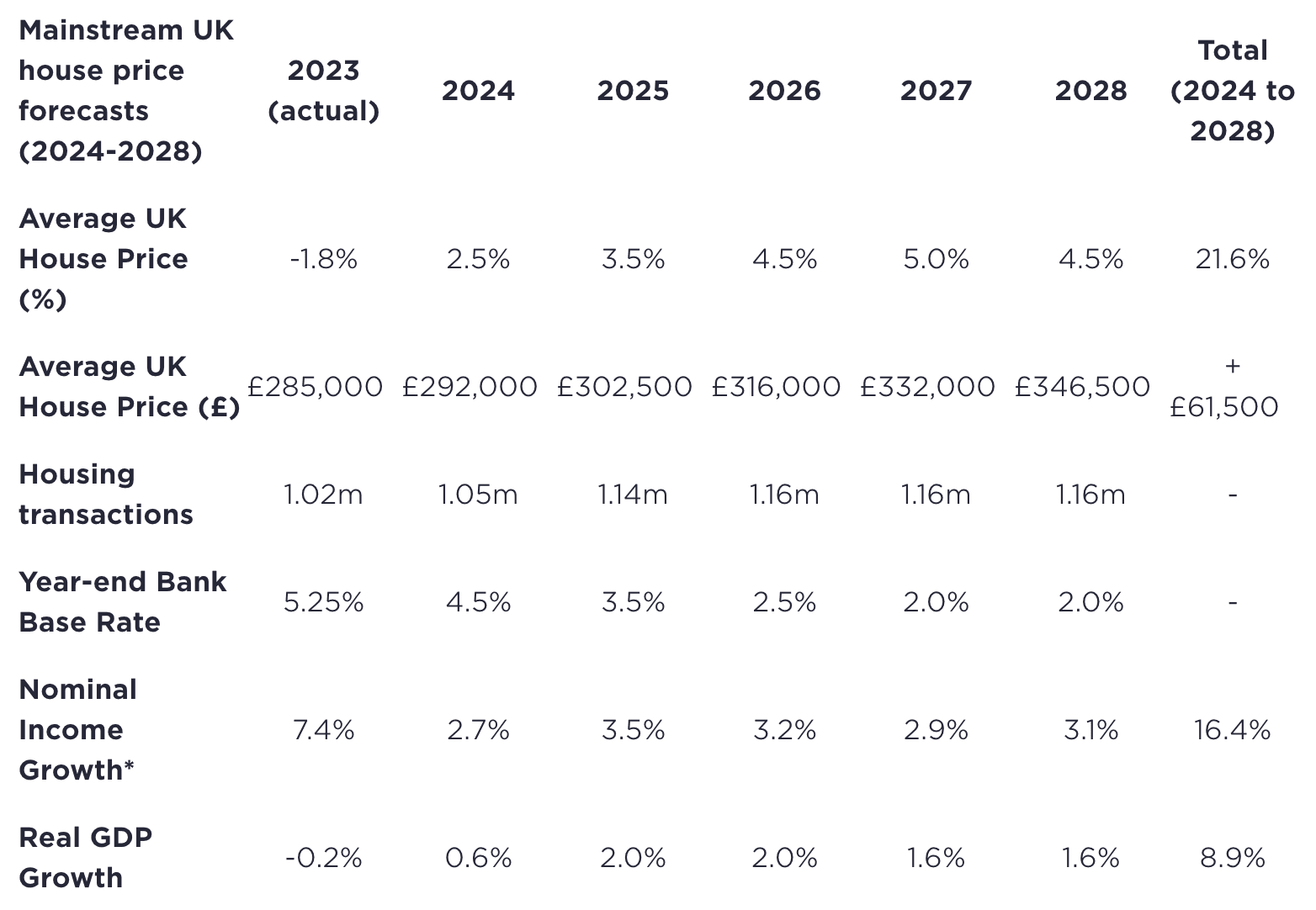

Savills revised forecast expects house prices to grow 2.5% in 2024 (revised from -3.0% as forecast in early November 2023), primarily due to falls in the cost of mortgage debt, and 21.6% by the end of 2028 (revised from 17.9%).

Housing transactions are forecast to reach 1.05 million in 2024, slightly up from the 1.01 million forecast at the back end of last year.

Source: Savills Research using Oxford Economics and Nationwide* (Note: These forecasts apply to average prices in the second hand market. New build values may not move at the same rate.)

“The outlook for 2024 has improved since our last (November 2023) forecasts as mortgage costs have nudged down slightly and are much less volatile. The outlook for economic growth has also slightly improved, pointing to relatively modest house price growth this year, with greater potential over the following few years.

“In November, a 75% LTV mortgage from Nationwide on a 2-year fix cost 5.34%, and mortgage approvals were down below 50,000 per month. The higher cost of debt dampened demand and put downward pressure on prices. However, the highly competitive nature of the mortgage market has meant that lenders have fairly aggressively priced in the prospect of cuts in bank base rate, causing buyer confidence, and prices, to recover somewhat,” comments Lucian Cook, head of residential research at Savills.

Today, while the bank base rate remains at 5.25%, the cost of the same Nationwide 2-year fixed-rate mortgage now stands at 4.84%, while a 5-year fix carries an interest rate of 4.50%.

This has caused monthly mortgage approvals to rise above 60,000 in February and March, with annual house price growth standing at to 0.6% at the end of April.

“However, continued uncertainty in the Middle East and higher than expected US inflation have meant that swap rates have continued to rise. Consequently, we are unlikely to see a further meaningful fall in mortgage rates this year, with the potential for short term fluctuations in the cost of debt and house prices, as seen over the past week. Similarly, an Autumn election could impact sentiment towards the end of the year, though polling suggests that most buyers and sellers will have already factored in a change of government, which will minimise the impact,” continued Mr Cook.

Looking to the longer term

Savills five-year UK forecast has been revised up from 17.9% to 21.6%, and the distribution of growth is expected to be more even over the five-year period.

According to Savills, a stronger economic performance in 2025 and 2026 will support buyer sentiment.

“Improving economic performance, combined with steady cuts to the base rate, will open up greater capacity for growth from 2025. But without the previously expected falls at the start of our forecast period, affordability constraints will become a factor towards the end of the five year period, particularly in the already stretched markets of London and the South East,” concludes Lucian Cook, head of residential research at Savills.

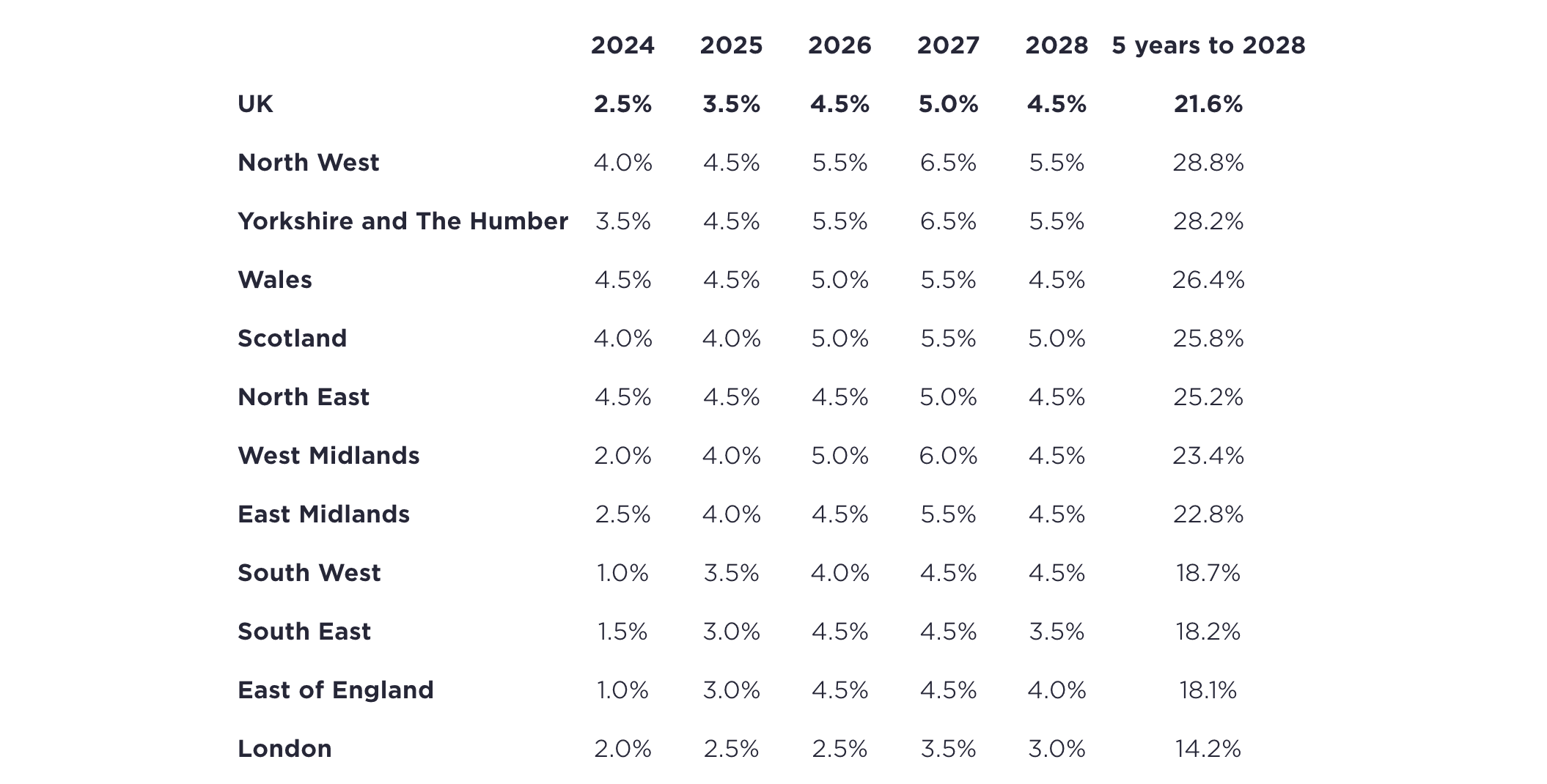

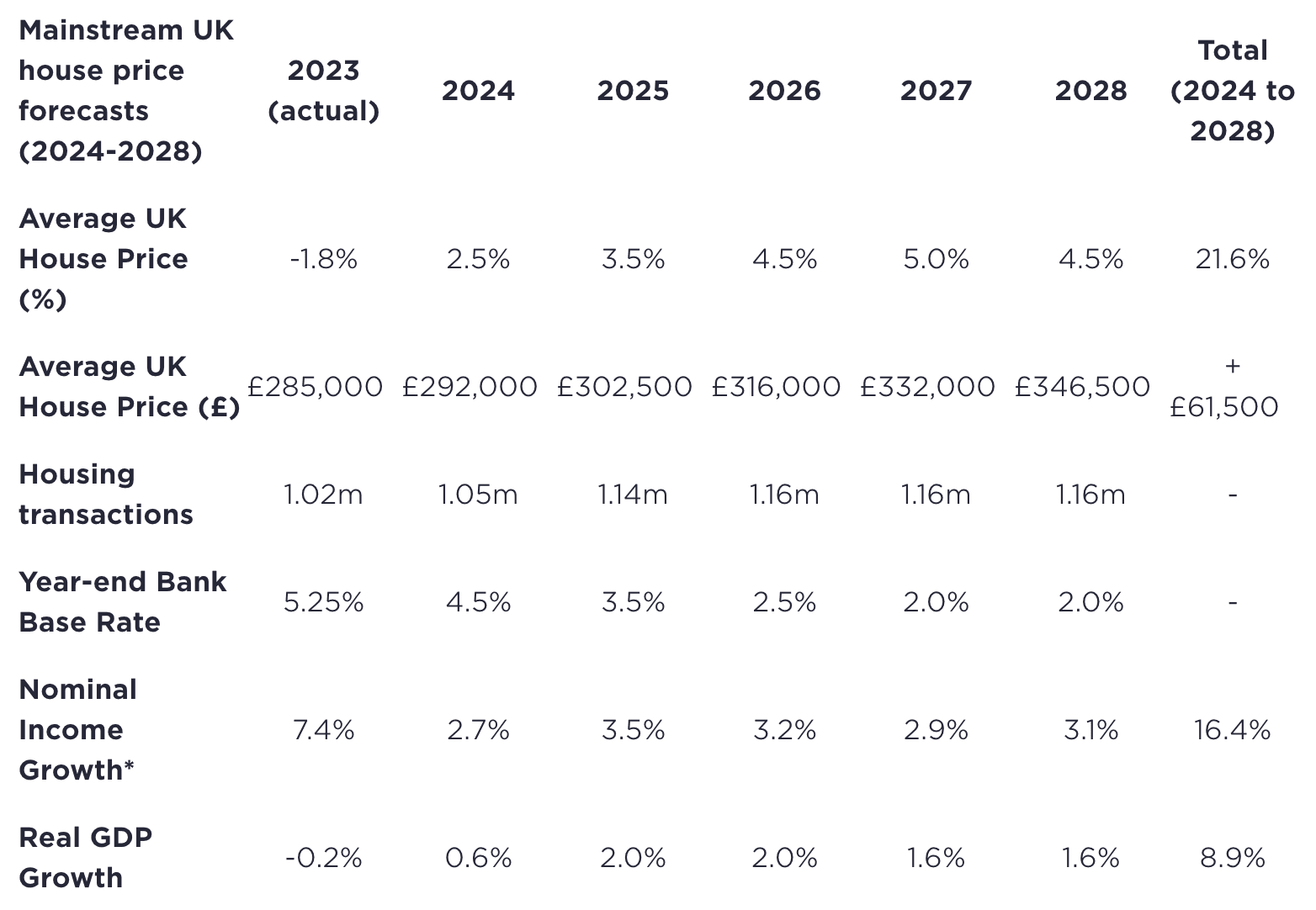

Savills revised forecast expects house prices to grow 2.5% in 2024 (revised from -3.0% as forecast in early November 2023), primarily due to falls in the cost of mortgage debt, and 21.6% by the end of 2028 (revised from 17.9%).

Housing transactions are forecast to reach 1.05 million in 2024, slightly up from the 1.01 million forecast at the back end of last year.

Source: Savills Research using Oxford Economics and Nationwide* (Note: These forecasts apply to average prices in the second hand market. New build values may not move at the same rate.)

“The outlook for 2024 has improved since our last (November 2023) forecasts as mortgage costs have nudged down slightly and are much less volatile. The outlook for economic growth has also slightly improved, pointing to relatively modest house price growth this year, with greater potential over the following few years.

“In November, a 75% LTV mortgage from Nationwide on a 2-year fix cost 5.34%, and mortgage approvals were down below 50,000 per month. The higher cost of debt dampened demand and put downward pressure on prices. However, the highly competitive nature of the mortgage market has meant that lenders have fairly aggressively priced in the prospect of cuts in bank base rate, causing buyer confidence, and prices, to recover somewhat,” comments Lucian Cook, head of residential research at Savills.

Today, while the bank base rate remains at 5.25%, the cost of the same Nationwide 2-year fixed-rate mortgage now stands at 4.84%, while a 5-year fix carries an interest rate of 4.50%.

This has caused monthly mortgage approvals to rise above 60,000 in February and March, with annual house price growth standing at to 0.6% at the end of April.

“However, continued uncertainty in the Middle East and higher than expected US inflation have meant that swap rates have continued to rise. Consequently, we are unlikely to see a further meaningful fall in mortgage rates this year, with the potential for short term fluctuations in the cost of debt and house prices, as seen over the past week. Similarly, an Autumn election could impact sentiment towards the end of the year, though polling suggests that most buyers and sellers will have already factored in a change of government, which will minimise the impact,” continued Mr Cook.

Looking to the longer term

Savills five-year UK forecast has been revised up from 17.9% to 21.6%, and the distribution of growth is expected to be more even over the five-year period.

According to Savills, a stronger economic performance in 2025 and 2026 will support buyer sentiment.

“Improving economic performance, combined with steady cuts to the base rate, will open up greater capacity for growth from 2025. But without the previously expected falls at the start of our forecast period, affordability constraints will become a factor towards the end of the five year period, particularly in the already stretched markets of London and the South East,” concludes Lucian Cook, head of residential research at Savills.

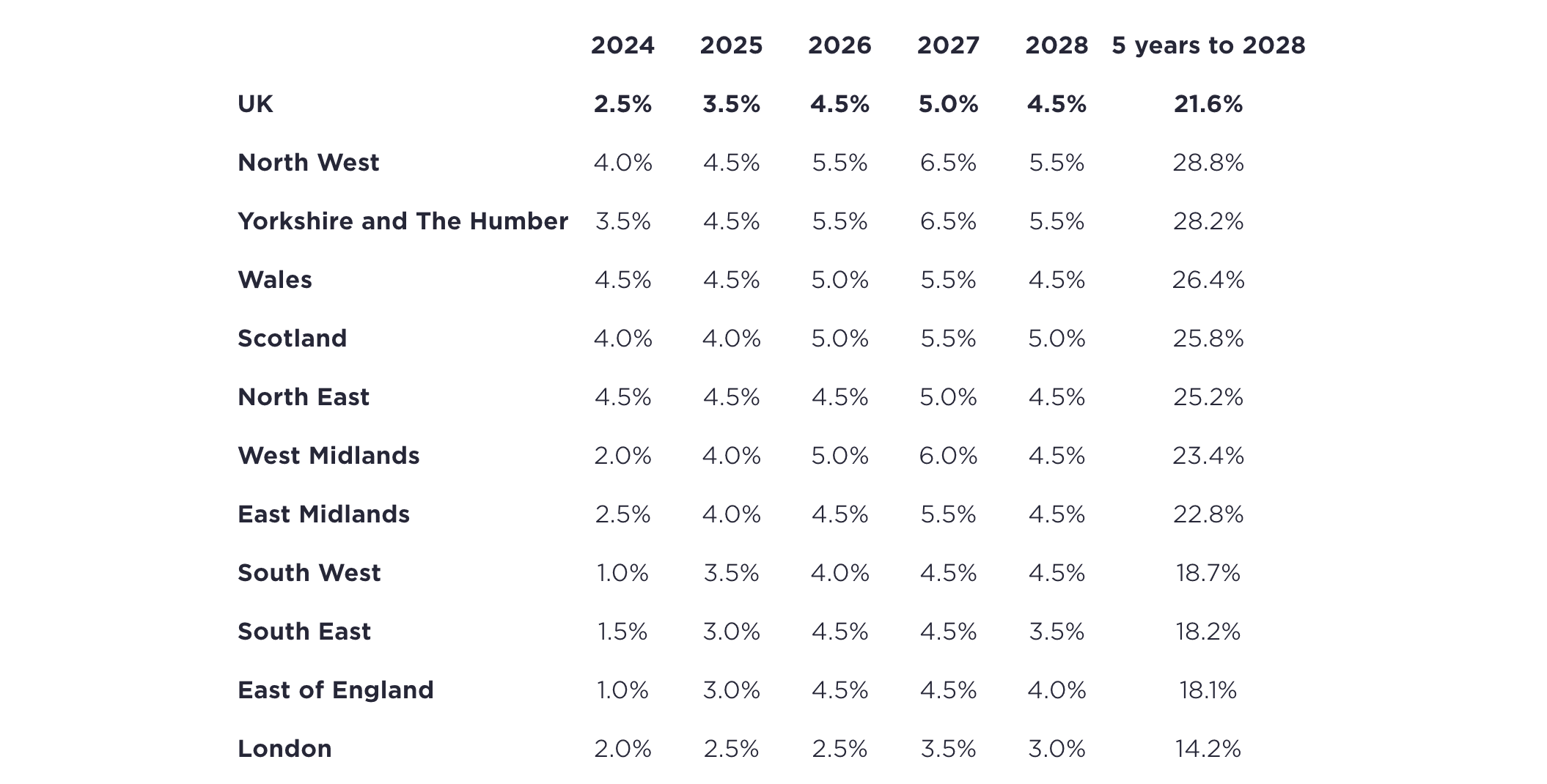

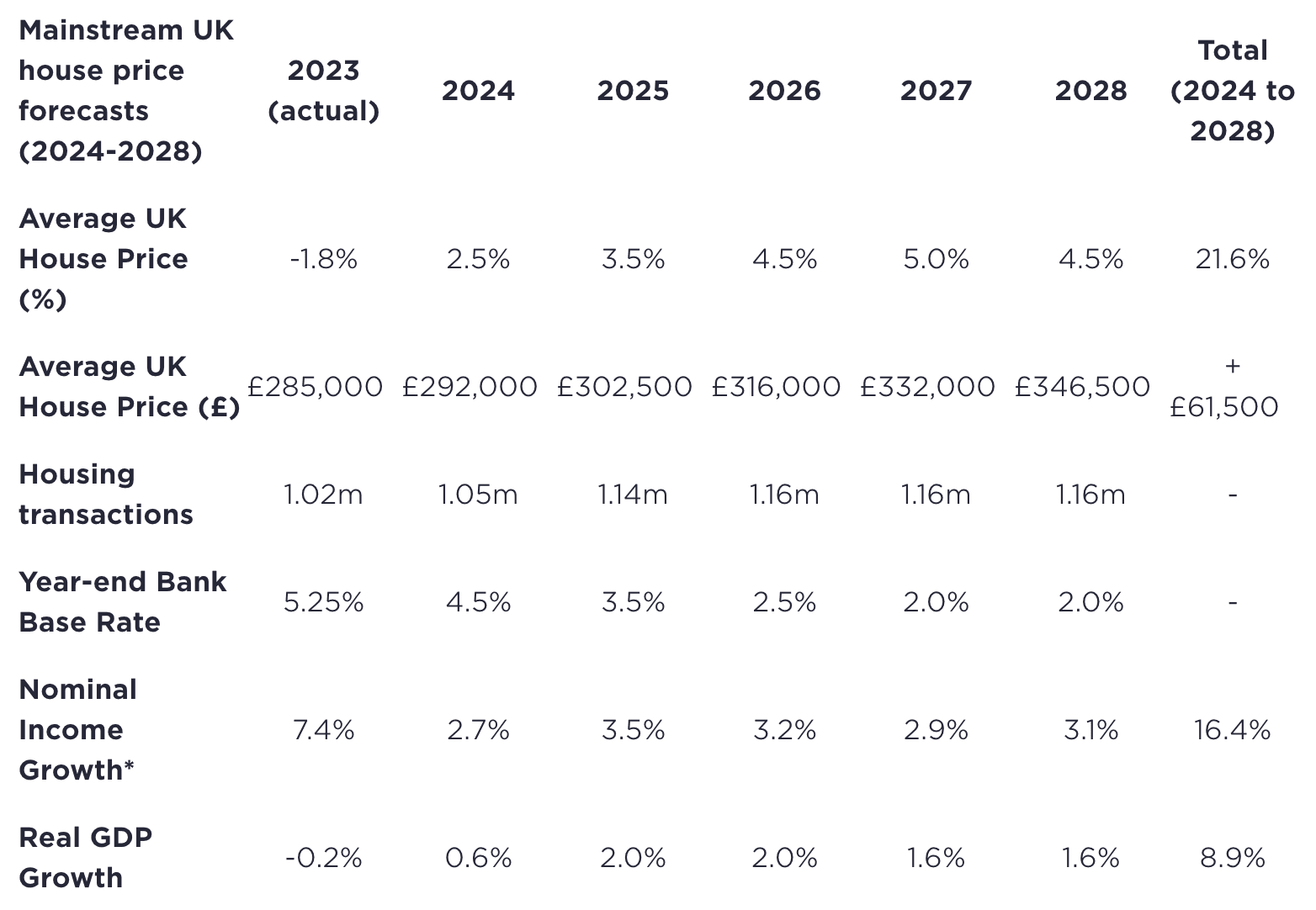

Savills revised forecast expects house prices to grow 2.5% in 2024 (revised from -3.0% as forecast in early November 2023), primarily due to falls in the cost of mortgage debt, and 21.6% by the end of 2028 (revised from 17.9%).

Housing transactions are forecast to reach 1.05 million in 2024, slightly up from the 1.01 million forecast at the back end of last year.

Source: Savills Research using Oxford Economics and Nationwide* (Note: These forecasts apply to average prices in the second hand market. New build values may not move at the same rate.)

“The outlook for 2024 has improved since our last (November 2023) forecasts as mortgage costs have nudged down slightly and are much less volatile. The outlook for economic growth has also slightly improved, pointing to relatively modest house price growth this year, with greater potential over the following few years.

“In November, a 75% LTV mortgage from Nationwide on a 2-year fix cost 5.34%, and mortgage approvals were down below 50,000 per month. The higher cost of debt dampened demand and put downward pressure on prices. However, the highly competitive nature of the mortgage market has meant that lenders have fairly aggressively priced in the prospect of cuts in bank base rate, causing buyer confidence, and prices, to recover somewhat,” comments Lucian Cook, head of residential research at Savills.

Today, while the bank base rate remains at 5.25%, the cost of the same Nationwide 2-year fixed-rate mortgage now stands at 4.84%, while a 5-year fix carries an interest rate of 4.50%.

This has caused monthly mortgage approvals to rise above 60,000 in February and March, with annual house price growth standing at to 0.6% at the end of April.

“However, continued uncertainty in the Middle East and higher than expected US inflation have meant that swap rates have continued to rise. Consequently, we are unlikely to see a further meaningful fall in mortgage rates this year, with the potential for short term fluctuations in the cost of debt and house prices, as seen over the past week. Similarly, an Autumn election could impact sentiment towards the end of the year, though polling suggests that most buyers and sellers will have already factored in a change of government, which will minimise the impact,” continued Mr Cook.

Looking to the longer term

Savills five-year UK forecast has been revised up from 17.9% to 21.6%, and the distribution of growth is expected to be more even over the five-year period.

According to Savills, a stronger economic performance in 2025 and 2026 will support buyer sentiment.

“Improving economic performance, combined with steady cuts to the base rate, will open up greater capacity for growth from 2025. But without the previously expected falls at the start of our forecast period, affordability constraints will become a factor towards the end of the five year period, particularly in the already stretched markets of London and the South East,” concludes Lucian Cook, head of residential research at Savills.

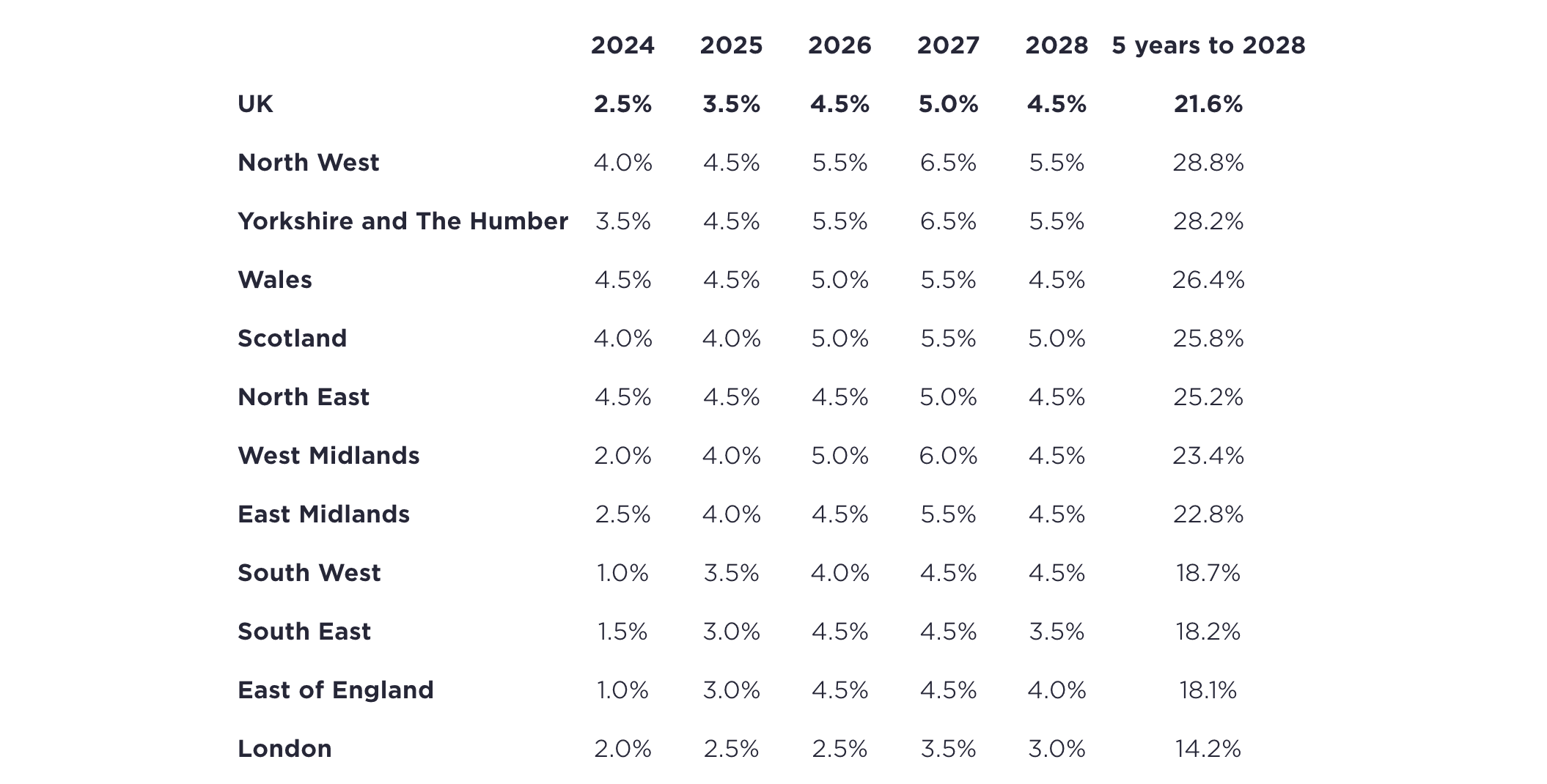

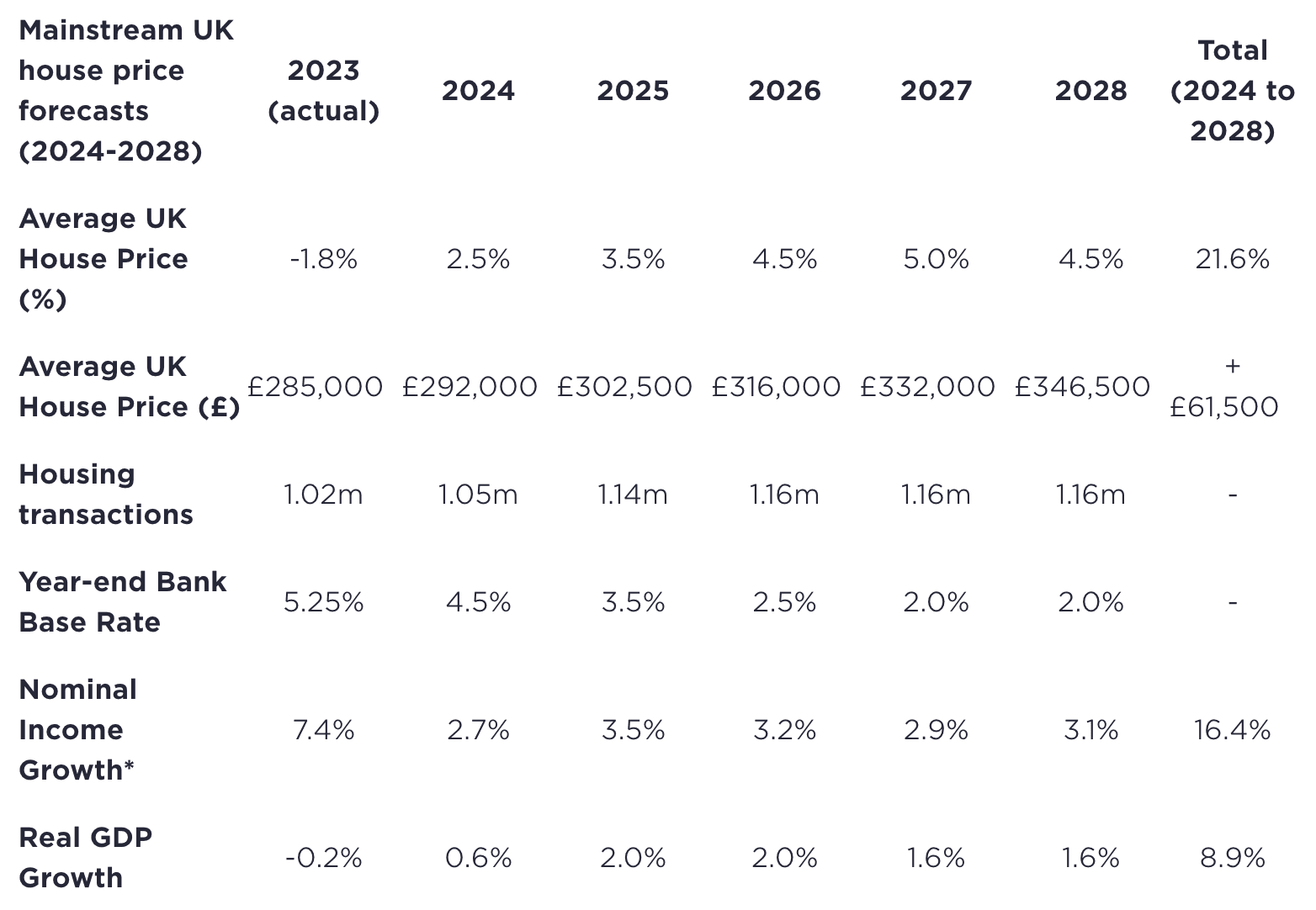

Savills revised forecast expects house prices to grow 2.5% in 2024 (revised from -3.0% as forecast in early November 2023), primarily due to falls in the cost of mortgage debt, and 21.6% by the end of 2028 (revised from 17.9%).

Housing transactions are forecast to reach 1.05 million in 2024, slightly up from the 1.01 million forecast at the back end of last year.

Source: Savills Research using Oxford Economics and Nationwide* (Note: These forecasts apply to average prices in the second hand market. New build values may not move at the same rate.)

“The outlook for 2024 has improved since our last (November 2023) forecasts as mortgage costs have nudged down slightly and are much less volatile. The outlook for economic growth has also slightly improved, pointing to relatively modest house price growth this year, with greater potential over the following few years.

“In November, a 75% LTV mortgage from Nationwide on a 2-year fix cost 5.34%, and mortgage approvals were down below 50,000 per month. The higher cost of debt dampened demand and put downward pressure on prices. However, the highly competitive nature of the mortgage market has meant that lenders have fairly aggressively priced in the prospect of cuts in bank base rate, causing buyer confidence, and prices, to recover somewhat,” comments Lucian Cook, head of residential research at Savills.

Today, while the bank base rate remains at 5.25%, the cost of the same Nationwide 2-year fixed-rate mortgage now stands at 4.84%, while a 5-year fix carries an interest rate of 4.50%.

This has caused monthly mortgage approvals to rise above 60,000 in February and March, with annual house price growth standing at to 0.6% at the end of April.

“However, continued uncertainty in the Middle East and higher than expected US inflation have meant that swap rates have continued to rise. Consequently, we are unlikely to see a further meaningful fall in mortgage rates this year, with the potential for short term fluctuations in the cost of debt and house prices, as seen over the past week. Similarly, an Autumn election could impact sentiment towards the end of the year, though polling suggests that most buyers and sellers will have already factored in a change of government, which will minimise the impact,” continued Mr Cook.

Looking to the longer term

Savills five-year UK forecast has been revised up from 17.9% to 21.6%, and the distribution of growth is expected to be more even over the five-year period.

According to Savills, a stronger economic performance in 2025 and 2026 will support buyer sentiment.

“Improving economic performance, combined with steady cuts to the base rate, will open up greater capacity for growth from 2025. But without the previously expected falls at the start of our forecast period, affordability constraints will become a factor towards the end of the five year period, particularly in the already stretched markets of London and the South East,” concludes Lucian Cook, head of residential research at Savills.